The most straightforward answer to the question: “do banks charge a fee for currency exchange?”, is an absolute yes!

Depending on who you bank with, the fees you are charged will vary. One of the most common reasons banks charge fees is when processing a currency exchange. While various institutions are starting to emerge that structure their fees differently, it is likely that if you want to change money – no matter how much – you will have to pay some form of transaction fee. But with a bank, it’s a sure thing.

Here, we fully explain currency exchange so that you can best arm yourself with the knowledge to choose the best currency exchange service for you. Your financial situation and how much you are exchanging – along with which specific currencies – will have a big bearing on what financial institutions best suit your needs.

What is a currency exchange?

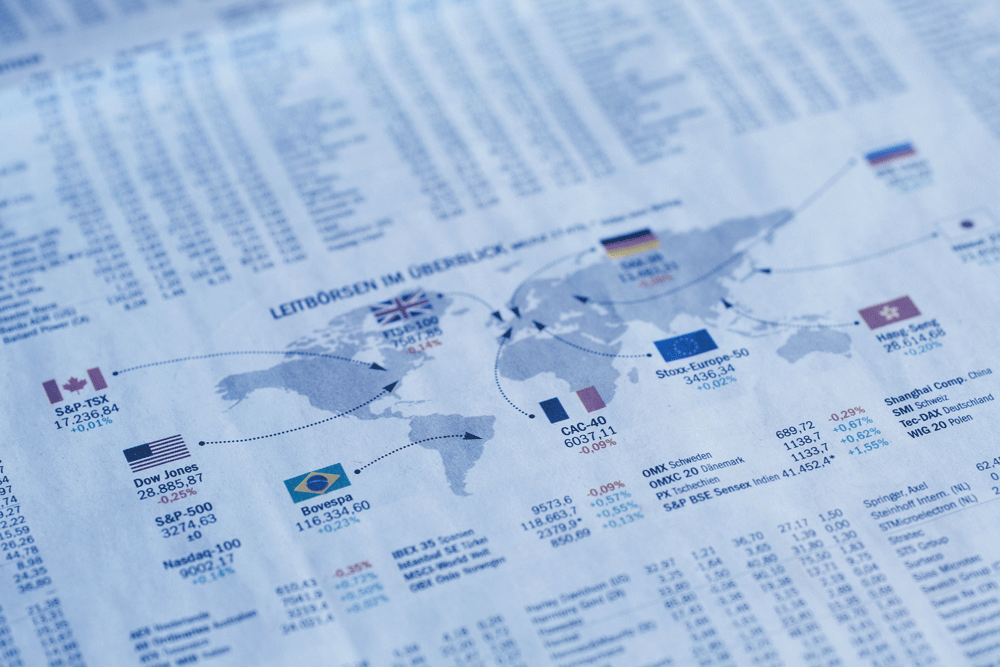

Currency exchange is the process of transferring one type of money from one country to another. So common examples would be changing one amount of US dollars into the same amount of Euros, or US dollars into British Sterling. Importantly, it is very unusual for two countries to have a like for like exchange rate. Instead, exchange rates are constantly changing. It means that the amount of Euros or Sterling that one US dollar can buy, varies every day – if not hourly.

Banks often charge fees on currency exchange as a way to maximize their profits. Exchanging several different currencies and having the right amounts needed to fulfil orders is a complicated and expensive process that holds a fair amount of risk for the bank. The constant fluctuations in the currency markets make it hard for them to make stable profit margins. For all these reasons, banks charge fees on currency exchanges as a way to minimize losses

How do banks charge a fee for currency exchange?

Banks or financial institutions charge fees on currency exchange in various ways. Some may charge many different fees at the same time. One of the main ways that people incur a fee on currency exchange is simply in the form of a transaction fee. That fee may be a set amount or it may be linked to the amount being transferred. I.e. the bigger the amount being exchanged, the bigger the fee.

Another common way that banks make money from currency exchange is through the rate they choose to exchange the two currencies. For example, say you want to use 1 US Dollar to buy as many Euros as possible. At present, that should buy you about 0.8. However, to make money, your bank may actually only give you 0.75. They pocket the extra 0.05. While that seems like a tiny amount in this instance, if you are exchanging a large amount of US dollars into Euros, and the bank takes 0.05 for each dollar exchanged, that really adds up.

Some banks also offer a service where you can buy back your currency at the rate you originally exchanged at. They will often charge a flat rate for such a service and that is another way they can make profit – though due to currency movements that profit may be minimized. However, it is a clever way of getting repeat customers.

Key takeaways

Banks almost always charge a fee for currency exchange. It can be an expensive service for them to offer, plus the constant fluctuations in exchange rates means that it is a volatile market for them to consistently make profits from. Charging fees to customers is a good way to stabilize those profits and have a more consistent income.

However there are some disruptors to the market, such as Cashero, offering currency exchange for much cheaper.

Content Disclaimer:

As of the date of publication, the information contained on this page is deemed to be factually accurate for all terms of conditions, features, and fees. Changes made to Cashero’s terms of conditions, features, or fees after the publication of this content may not be accounted for.

App Disclaimer:

The Cashero App is now available for download in both the Apple App Store and Google Play Store, though not all features are currently functional. Cashero has not yet officially launched.