A debit card is essential to bring when traveling, both domestically and internationally. Many travelers ask if they can use their debit card in another country. Debit cards generally work internationally, thanks to the massive global networks of Visa and Mastercard (and other financial service companies). That means that you can use your card to pay for any purchases and to withdraw local currency from ATMs – wherever you are. But there are some things to keep in mind.

How To Use a Debit Card in Another Country

There are a few limitations with debit cards, as well as some things you have to plan for when it comes to using your card abroad. Similar to credit cards, you need to be wary of how you use your debit card in another country.

What to Do Before Using a Debit Card Abroad

Before doing anything, take a look at your debit card. Most debit cards have a Visa or Mastercard logo tacked onto them. These labels tell you that you can use your card wherever these financial services are found.

There may also be symbols like PLUS, Cirrus, or Maestro, that tell you to which network your debit card belongs. Keep this in mind – debit cards mostly only work in ATMs with the same label. If an ATM doesn’t have the same symbol on your card, it might not be compatible and you won’t be able to make a withdrawal.

Some debit cards are automatically programmed to function abroad. That means you can simply hop on a plane, land in another country, and use your card as confidently as you would back home.

But this isn’t always the case.

Tips for Using Debit Cards in Another Country

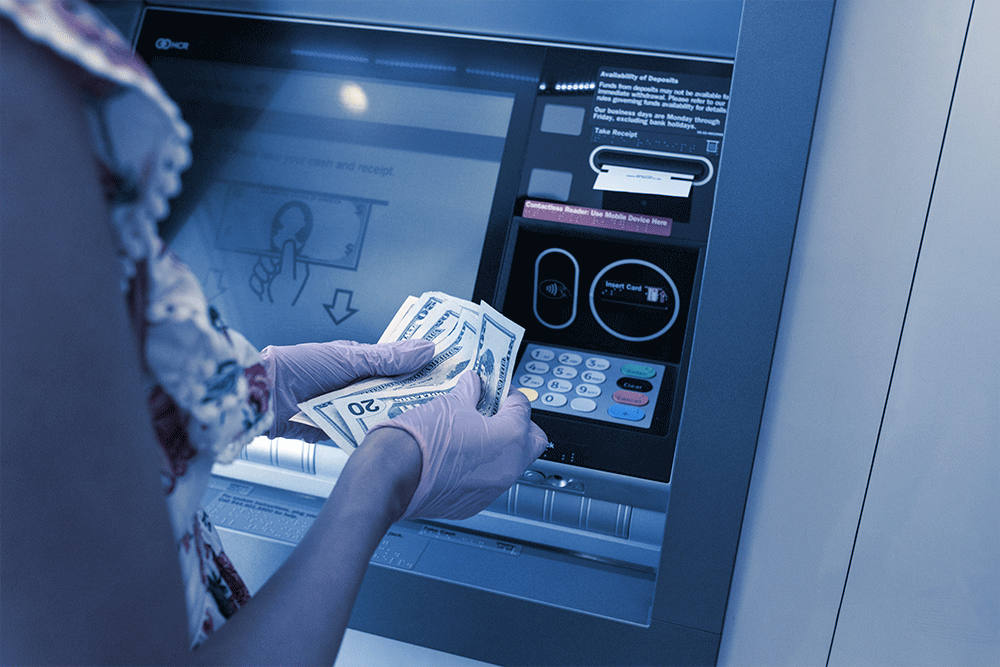

Most banks have a conversion fee when you use an ATM. To minimize racking these up, it’s best to avoid making multiple withdrawals. Instead, you should take out a large amount and then break that up as you need it as a daily allowance. That way you’ll save on being hit by both the currency conversion fee and the ATM fee.

When using a debit card abroad, you’re likely to be asked whether you want to pay in your debit card’s default currency (i.e. your home country’s currency) or the local currency. While it seems more convenient to go with the former, this will often incur more fees because either there’s an in-store conversion fee or you’ll get a poor exchange rate.

Always keep your debit card in a safe place. Ideally, you should leave it in your hotel room or safe, and only carry the cash you need. Consider using a wallet with zippers or a money belt to keep the card secure if you must take it out. If you lose it, immediately contact your financial institution or platform for assistance. Another option before you travel is to pay hotels and other large expenses in advance with instant transfer through your banking institution. One caveat here may be the amount of money that can be wired.

Summary

Traveling abroad with your debit card can make a big difference in how easy it is to pay for your purchases and get money out of local ATMs. It’s important to be smart about how, where, and when you use the card. If you follow the tips we’ve laid out in this article you should be able to use your card in another country without any problem.

Also read: How Much Can Be Transferred Without Having to Report It?

Content Disclaimer:

As of the date of publication, the information contained on this page is deemed to be factually accurate for all terms of conditions, features, and fees. Changes made to Cashero’s terms of conditions, features, or fees after the publication of this content may not be accounted for.

App Disclaimer:

The Cashero App is now available for download in both the Apple App Store and Google Play Store, though not all features are currently functional. Cashero has not yet officially launched.